Connecting the Dots Between Real Estate & Taxes

We’re not “tax people”––we’re real estate professionals. But as tax day quickly approaches, we want to share possible tax-saving strategies pertaining to real estate. Whether

We’re not “tax people”––we’re real estate professionals. But as tax day quickly approaches, we want to share possible tax-saving strategies pertaining to real estate. Whether

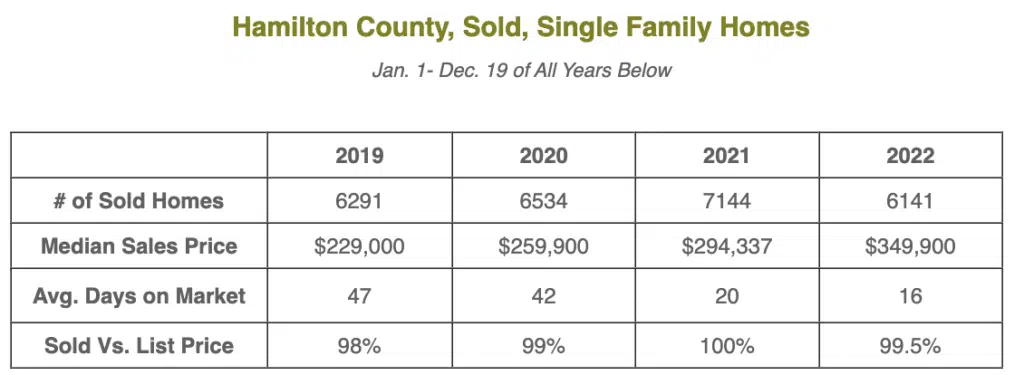

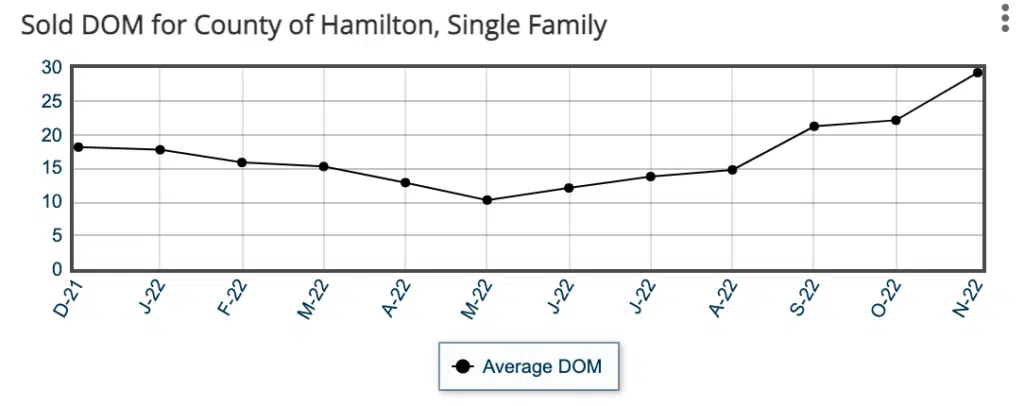

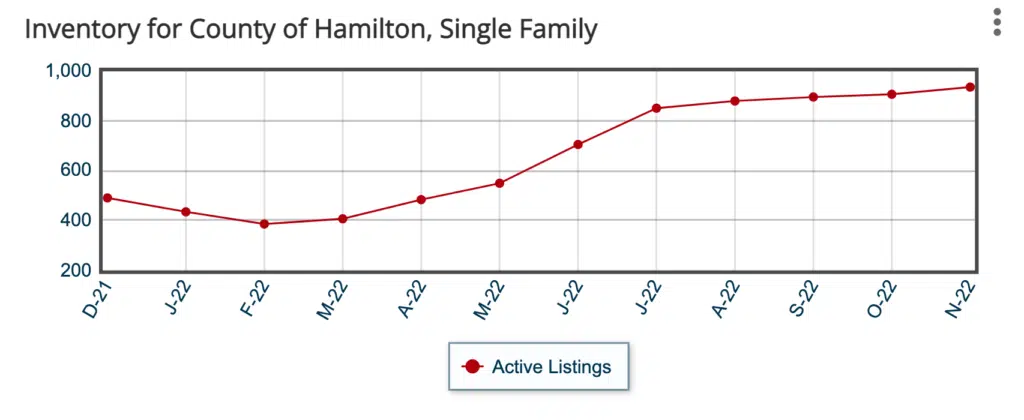

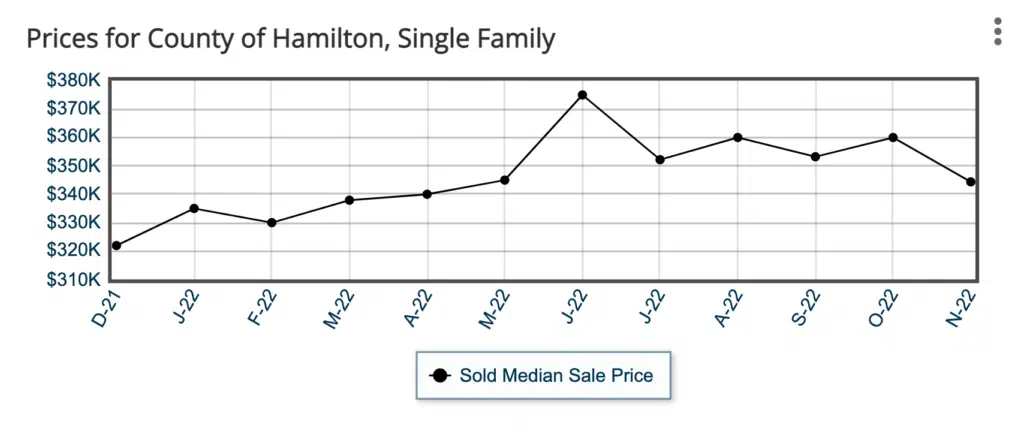

Rumors and speculation abound, but data + expertise clear the fog. So, how did our local real estate market fare in 2022 and where is it trending?

We all want to make wise, data-driven real estate decisions, right? To do so, it’s never been more critical to look beyond headlines and view

Conservation Easements 101: The Basics and Benefits of Conserving Land Kat Szymanski and Todd Henon Properties Realtor, Rhey Houston • 11 Oct, 2022 As a

It’s estimated, nearly 1/3 of America’s current home buyers are looking to relocate to a more affordable region. This mass migration presents an opportunity for Tri-State property owners to

As spring comes into bloom, the real estate world typically sees its busiest season, and 2022 is no exception. As of April 12, local homes

From Wall Street to local lenders, the country is seeing an uptick in interest rate percentages. However, experts are not alarmed, and we are

We’re not “tax people”––we’re real estate professionals. But as tax day quickly approaches, we want to share possible tax-saving strategies pertaining to real estate.

Whether reminders or new thinking for your portfolio, we encourage you to consider these tax strategies and, of course, speak with your tax professional.

Our full-service Team is honored to be your real estate resource for Buying, Selling, and Investing. Need a trusted local CPA, tax strategist, attorney, or estate planner? We’re here to put our 30-year network to work for you.

It would be our privilege to sit down soon to discuss your goals.

Our Team of Experts

Rhey Houston, Brittany Fulmer Ennen, Melanie Siler, Sabie Crowder Hennen, Angela Volner, Jim Woodard, Liv Clary, Savannah Ward, Koty Pearse, Beth Bragg Henon, and Todd Henon.

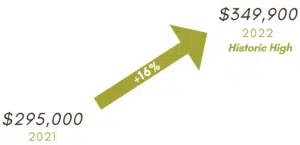

Record Breaker

Looking Ahead…

Fastest in History

Supporting Data via Greater Chattanooga Multiple Listing Service

If your 2023 goals include real estate–home, investment, recreation, relocation or commercial—we would be honored to sit down and have a conversation. Call us at 423.413.4507.

Sources: GCAR MLS, fred.stlouisfed.org

The driving force in today’s premium-priced Real Estate market is the basic law of supply & demand. Economists predict demand will likely exceed supply nationwide for the next 4-10 years keeping prices and values at a premium.

We’ll explore that next time…

Kat Szymanski and Todd Henon Properties Realtor, Rhey Houston • 11 Oct, 2022

As a landowner or prospective buyer of land, you have many choices for how you might handle your land as an asset. For instance, you could hold your land for future appreciation, or you could contribute additional capital and expertise to develop the property into a commercial or residential enterprise. One other less obvious alternative might be to consider conserving the property and enjoying the benefits associated with this unique property vision.

Understanding the costs and benefits associated with each of these choices could significantly benefit you and dramatically enhance your long-term property outcome.

A conservation easement could be a large factor in whether you decide to purchase land real estate, or it could hinder the sale of your property sometime in the future. That said, there are potential tax benefits associated with conservation easements, as well as substantial benefits for the public.

What is a Conservation Easement: An In-Depth Look

The concept of conservation easements is easy to understand at first glance — it’s simply a set of restrictions on a piece of land designed to ensure that the historical or conservation value of the land is protected. However, while the concept is simple, how conservation easements work is a bit more challenging to discern.

Many parcels of land often include areas that a conservation agency or private land trust wishes to preserve for either historical value, conservation value, or both. The conservation easement is the agreement between the landowner and the agency or trust that defines specific terms regarding the protected areas.

While each conservation easement can vary based on the particulars of the specific property, common easement terms typically include:

The exact terms can often be negotiated between the conservation group and the landowner. However, the conservation easement that is created will then apply to all future buyers of land real estate on which the conservation easement exists. This ensures that the land continues to be protected, regardless of ownership.

Donating Land for a Conservation Easement

Owners of land real estate may be approached by a private land trust or conservation agency that wishes to protect some or all of the land. If no conservation easement currently exists, the landowner does not have to donate the land to the conservation group. However, there are often benefits to doing so, which is why many conservation easements are created each year.

In fact, the number of land conservation easements in the United States is now larger than the number of national parks, forests, and state parklands. The USDA and private landowners have partnered to enroll over 5 million acres of wetlands, grasslands and prime farmlands in conservation easements. These easements serve to protect many scenic, historical, and biological resources.

When a landowner donates land to a conservation easement, they still retain ownership and control of the property and can determine who has access to the property. The conservation agency is simply responsible for enforcing the terms of the agreement reached between the two parties.

Benefits of Donating Land for a Conservation Easement

Conservation easements often serve to make a positive difference in many communities by providing a protected area that may supply clean water, productive farmland or forests, thriving wildlife habitats, or even just some lovely scenic views. Each conservation easement is often created to fulfill a specific purpose. The majority, however, are usually meant to help maintain and protect ecological communities and wildlife. Conserving land is also an important factor in helping to combat climate change, as well as preserve historic areas and legacies.

While many landowners see the value to the surrounding communities and the environment by conservation easements, federal or state tax benefits are often a key factor in the decision to donate land.

The landowner that donates land to a conservation easement is entitled to an income tax deduction for the value of the land. Typically, a real estate appraiser will determine the land’s value and easement’s value. The donation of the land counts as a charitable gift which must be reported to the IRS. It should be noted that while land with a conservation easement is taxed at a lower value, any existing buildings and structures currently on the land are taxed at the standard rate.

The donation of land also affects the tax valuation of the property as a whole, which can significantly lower the estate tax that may be due upon the donor’s death. Additionally, estate tax exclusions may also be allowed under certain circumstances. And, depending upon the state in which the conservation easement exists, reduced property taxes might also be applicable.

In Conclusion

Creating a conservation easement is a process. As a landowner, you don’t necessarily have to wait for a private land trust or government conservation agency to come to you. You can contact agencies of your own accord and state your intent to donate land. This serves the dual purpose of enabling you to benefit from tax incentives and protect the beauty of your land for future generations.

If you are interested in purchasing land real estate, be sure to inquire whether any conservation easements currently exist on the property you are interested in. If you have a specific purpose for the land you want to purchase, easement restrictions may prevent you from doing so.

A first recommended step would be to consult with a land consultant who has the expertise and experience to help you successfully navigate this process.

Never Settle. Let land expert Rhey Houston, who has participated in conserving 10,000± acres, and Chattanooga’s 1st Accredited Land Consultant, Todd Henon, serve you.

A special thank you to Kat Szymanski for allowing us to share this article.

Realtor TN, GA

Realtors Land Institute, TN

Conservation Specialist

Broker-Realtor TN, GA, AL

Chattanooga’s 1st Accredited Land Consultant

Realtors Land Institute, TN

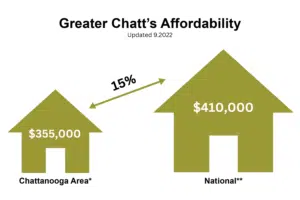

It’s estimated, nearly 1/3 of America’s current home buyers are looking to relocate to a more affordable region.

This mass migration presents an opportunity for Tri-State property owners to capitalize on our region’s AFFORDABILITY.

While home values in the Chattanooga area are enjoying a steady rise,

local housing prices are 20% below the national average.

Todd & Team

20+ Years Serving the Tri-State

Brittany, Rhey, Sabie, Angela, Melanie, Andrew, Beth, Jim, and Savannah

*Source: Greater Chattanooga MLS, **National Association of Realtors

As spring comes into bloom, the real estate world typically sees its busiest season, and 2022 is no exception. As of April 12, local homes under contract rose to 921, which was up from 809 just last month.*

With nearly 1/3 of current home buyers in the U.S. seeking to relocate to a more affordable region, (National Association of Realtors, 2.23.22), this spring season is shaping up to be yet another full real estate season.

The slow rise in inventory, plus more people planning to move this year could be another reason to consider putting your home on the market. Not to mention, Tennessee continues to be a top spot for said relocators.

In 2021, Tennessee placed in the top three U-Haul’s top 50 states for growth analysis. Chattanooga has also made the rankings of several U.S. News listings including:

Additionally, Georgia remains one of the fastest-growing states in the U.S. and on the radar for many looking to make a move. “With a 10-year growth rate of 14.4%, Georgia’s state growth is more than 1.5 times that of the U.S. population growth rate. The state will add more people in the years to come; population projections forecast a 17.7% increase in Georgia’s population by 2030.” Bankrate.com

Whether you’re moving yourself, or hoping to capitalize on the growing market, our Team is here to help you know, understand and maximize today’s data and trends.

Comment below or contact us at 423.413.4507 to begin the conversation.

Todd & Team

Brittany, Rhey, Sabie, Angela, Melanie, Andrew, Beth, Jim, and Savannah

*Source: Greater Chattanooga MLS, Single Family Homes, Hamilton County

From Wall Street to local lenders, the country is seeing an uptick in interest rate percentages. However, experts are not alarmed, and we are directed toward a more balanced, appropriate, and fair market.

Whether selling, buying, scrolling Zillow, or a quiet observer, recent headlines make it impossible to miss that interest rates for home loans are beginning to climb.

Forbes recently shared how rates have steadily climbed from historic lows at 2.88% to now just over 3.4%.

Balance is gradually being restored, and the realm of real estate may be getting back in tune with something akin to harmony…especially in the height of the spring listing season just around the corner.

National Association of Realtors Chief Economist Dr. Lawrence Yun shared in a Tweet that “more residential construction and industry trade contractor jobs…are now far ahead of the numbers seen before the pandemic, implying more home-building and more supply are forthcoming,” giving a nod to the potential of new construction across the country.

Furthermore, in our local market, options are growing even as inventory stays low. New neighborhoods continue to rise especially in East Brainerd, Ooltewah, and Apison. Sale Creek and Soddy Daisy also offer hope for more inventory in the coming months alongside the new industrial park planned on the McDonald Farm property bringing mixed use and recreational venues.

A recent story published in the Chattanooga Times Free Press also showed building permits being pulled at all time high for Signal Mountain’s Walden’s Ridge:

“In 2021, homebuilders raced to pull new single-family home permits on the ridge amid a strong housing market countywide, figures show. New permitted residential units climbed 64% on the ridge last year compared to 2020, according to the Chattanooga-Hamilton County Regional Planning Agency…the most annually in at least 15 years.”

Here to serve,

Todd & Team

Brittany, Rhey, Sabie, Angela, Melanie, Andrew, Beth, Jim, and Savannah

423.413.4507

(P.S. Seeking a New Career? We’re Hiring.)

Todd Henon Properties 423.413.4507 direct Info@ToddHenon.com Keller Williams Realty Greater Downtown Realty 1830 Washington Street Chattanooga, TN 37408 423.664.1900

GREATER CHATTANOOGA

SERVING TN, GA, AL

LICENSED TN GENERAL CONTRACTOR

GREATER CHATTANOOGA

INVESTMENT, RECREATIONAL,

DEVELOPMENT, CONSERVATION,

AGRICULTURE

FOR UNIVERSITY OF TN CHATT, ERLANGER HOSPITAL

AGENTS OF CHOICE

AWARD-WINNING MARKETING

SPECIALISTS, CONTRACT MANAGERS,

RESEARCH & LOGISTICS EXPERTS

CHATTANOOGAN

TODD HENON

KELLER WILLIAMS REALTY

GREATER DOWNTOWN

1830 Washington Street Chattanooga, TN 37408 423.664.1900

© 2023 Todd Henon Properties of Chattanooga | Keller Williams Realty Greater Downtown Chattanooga. All rights reserved.

Each Keller Williams office is independently owned and operated. 423.664.1900

Realtor Showing Center | 888.594.8304

Privacy Policy | Terms of Service | EULA | Disclaimer | Accessibility Policy