Chattanooga Ranked Best Place To Retire in U.S. South

Chattanooga Times Free Press September 22, 2023 Chattanooga has been rated as the best place to retire in a comparison of 41 top-rated cities across

Chattanooga Times Free Press September 22, 2023 Chattanooga has been rated as the best place to retire in a comparison of 41 top-rated cities across

Originally Published by Chattanooga Times Free Press July 12, 2023 Sold by Todd Henon Properties, June 2023 for 100% of List Price Beverly McGregor has

Chattanooga, Tennessee, the “Scenic City,” has seen a surge in popularity in recent years. The city offers picturesque surroundings, outdoor recreational opportunities, and a thriving local economy. In

We’re not “tax people”––we’re real estate professionals. But as tax day quickly approaches, we want to share possible tax-saving strategies pertaining to real estate. Whether

Original Broadcast 9/2023 Realtors Todd Henon and Brittany Fulmer Ennen of Todd Henon Properties join “Let’s Talk Money,” hosted by Jim Place and Jayme O’Donnell

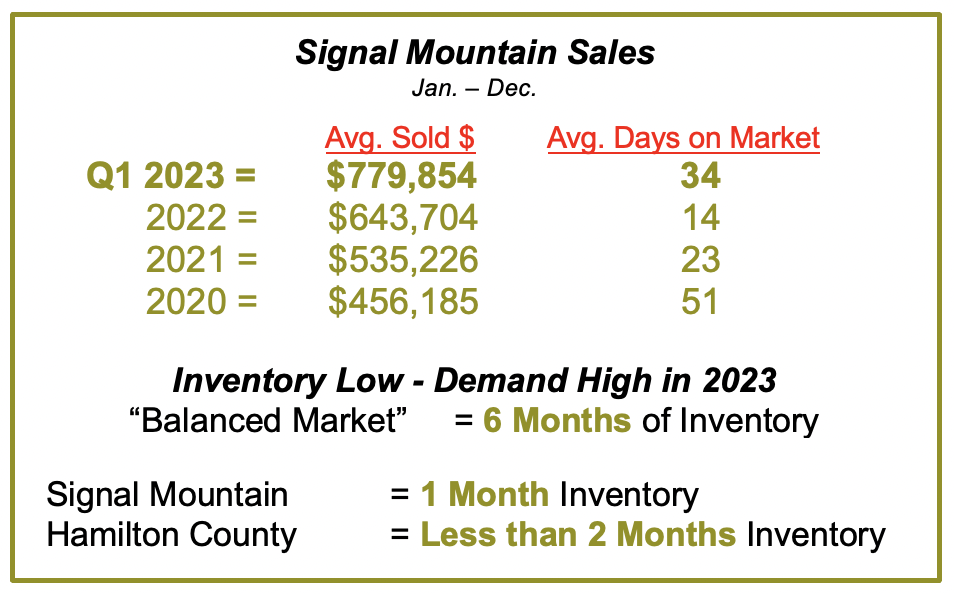

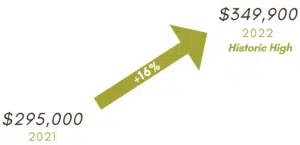

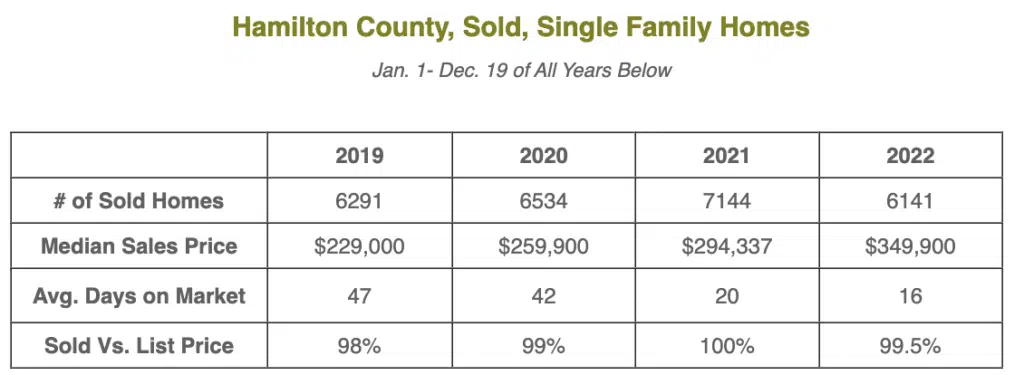

Rumors and speculation abound, but data + expertise clear the fog. So, how did our local real estate market fare in 2022 and where is it trending?

We all want to make wise, data-driven real estate decisions, right? To do so, it’s never been more critical to look beyond headlines and view

Chattanooga has been rated as the best place to retire in a comparison of 41 top-rated cities across the South in a new analysis by Southern Living and Investopedia. The magazine compared each place’s housing affordability, the prevalence of restaurants, hospitals, colleges, and other economic and demographic data to determine that Chattanooga was the best city all-around to retire in. Carolanne Griffith Roberts, a writer for Southern Living, said Chattanooga is an affordable, attractive and hospitable city that offers lots to do but still retains a small-town vibe.

“This spot ticks all of the boxes for a great retirement town — including being a magnet for your children and grandkids,” Roberts wrote about Chattanooga in this month’s Southern Living magazine. “It’s a particularly great spot if you have grandkids, who might be interested in visiting attractions like the Tennessee Aquarium, Creative Discovery Museum and the Incline Railway at Lookout Mountain.”

Florida was the most popular state to move to in 2022 with 319,000 new residents last year, or about 874 people moving into Florida every day, according to census data. But moving data show

that Tennessee was the one state that attracted more people moving from Florida than the number that migrated from Tennessee to the Sunshine State.

“We have four great seasons and a lot lower taxes and cost of living,” Chattanooga developer John “Thunder” Thornton said in a telephone interview Friday. “That’s why we’ve attracted retirees here from all 50 states and why I am confident in saying this is the No. 1 greatest state for retirement.”

During the past decade, Thornton has lured hundreds of retirees from across the nation to his mountaintop development known as Jasper Highlands near Kimball, Tennessee, just west of Chattanooga. Thornton is now marketing an even bigger development known as River Gorge Ranch on Aetna Mountain near Chattanooga. Bob and Linda Miklos were one of the first to move into Jasper Highlands eight years ago when they relocated from Connecticut to retire in East Tennessee.

“We were looking for lower taxes, more livable weather and a conservative government and brand of people,” Linda Miklos said in a telephone interview Friday. “But it was also important to us to have a close connection with a great city. We did our homework and found Chattanooga met the test. We evaluated it for ourselves and fell in love with the vibe of the city, the many great events,

great restaurants, and of course, the river and boardwalk.”

Dane Bradshaw, president of Thunder Enterprises, which developed Jasper Highlands and is now working on plans for both the River Ranch Gorge and Riverton in Chattanooga, said East

Tennessee continues to gain the attention of more retirees looking to relocate. “It’s a trend that seems to grow bigger every year since we first opened Jasper Highlands a decade ago,” Bradshaw said. “A lot of retirees are moving here because of the pain of where they are coming from and that can be politics, taxes, cost of living or climate.”

Southern Living and Investopedia identified the best places to retire in the South, overall and in several categories.

— Chattanooga, best all-around.

— Huntsville, Ala., for affordability

— Abingdon, Va., for outdoor enthusiasts.

— Greenville, S.C., for food.

— Blowing Rock, N.C., best mountain town.

— St. Augustine, Fla., best beach town.

— Savannah, Ga., best for arts and culture.

— Beaufort, N.C., best for healthy living.

— Eureka Springs, Ark., best access to nature.

— Fort Worth, Texas, best for city lovers.

— Lexington, Ky., best for lifelong learning.

— Ocean Springs, Miss., best for home-buying.

Source: Southern Living

Tennessee boasts the second lowest per capita tax rate in the nation, behind only Alaska, and had the nation’s second fastest-growing economy last year, according to government figures. The

Volunteer State still retains comparatively more affordable real estate and better recreation scene than most states, Roberts said.

Miklos and other retirees also praise the Southern hospitality of the Chattanooga area.

“This is a never-met-a-stranger community,” former Chattanooga Mayor Bob Corker, who is now retired from the U.S. Senate, said in an interview with Southern Living magazine. “People encourage you to be part of things bigger than yourself.”

Contact Dave Flessner at dflessner@timesfreepress.com or 423-757-6340

Originally Published by Chattanooga Times Free Press July 12, 2023

Beverly McGregor has bought and sold four of her own homes in the Chattanooga area over her lifetime, but even with decades of such experience, she said she was surprised to see the higher prices for houses in today’s market.

“I never dreamed that home prices would get this high in our area, but we were able to find a great home that my friend and I are able to buy by both of us selling our previous homes,” said McGregor, a retired special education teacher who moved into her new home in Lakesite in late June.

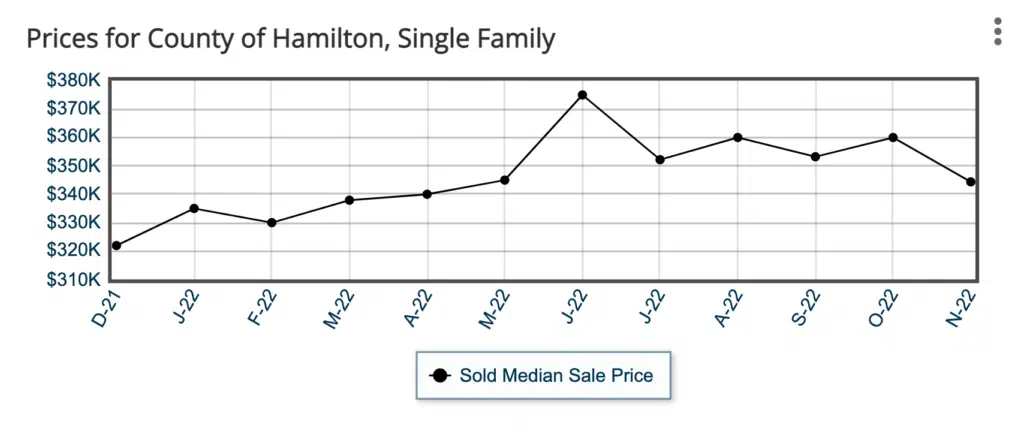

Although Chattanooga home prices remain nearly 20% below the U.S. average, the median price of homes sold last month by Greater Chattanooga Realtors jumped to a new record high of $339,950 — more than $200,000 higher than a decade ago.

Chattanooga home sales dropped by nearly 15% in the first half of the year as higher mortgage rates are slowing the market from the record levels reached two years ago, according to the Realtors. But home prices remain elevated even with lower sales and higher borrowing costs.

The median price of $339,950 means half the homes in June sold for more than that, and half sold for less.

The average Chattanooga home price, which reflects the total value of all home sales divided by the number of houses sold, was $392,901 in June, according to the Realtors’ multiple listing service.

The price of homes sold in Chattanooga has more than doubled in the past seven years, rising at an average annual rate of more than 15%, according to reports by the Realtors organization.

The price increases have come even as 30-year mortgage rates, which dipped below 3.3% in early 2022, have since doubled to further boost the cost of housing for most homebuyers who finance their purchases.

“Affordability is obviously more of a challenge with higher mortgage rates and prices, but we are still seeing a lot of relocation activity from people moving to Chattanooga and from changing housing needs by those already in the market,” said Steven Sharpe, a managing broker for Keller Williams, who is president of the Greater Chattanooga Realtors. “There are a lot of people who are either downsizing because they are empty nesters with a smaller family size or others that are looking for more room and want to move up, especially with more people

working from home these days.”

$339,950: Median price of homes sold in June in the Chattanooga area, up 3.4% from the previous

record high of $328,725 in June 2022.

$436,800: The median price of homes sold nationwide in the first quarter of 2023.

5,929: The number of homes sold in the Chattanooga area in the first six months of 2023, down from 5,100 a year earlier.

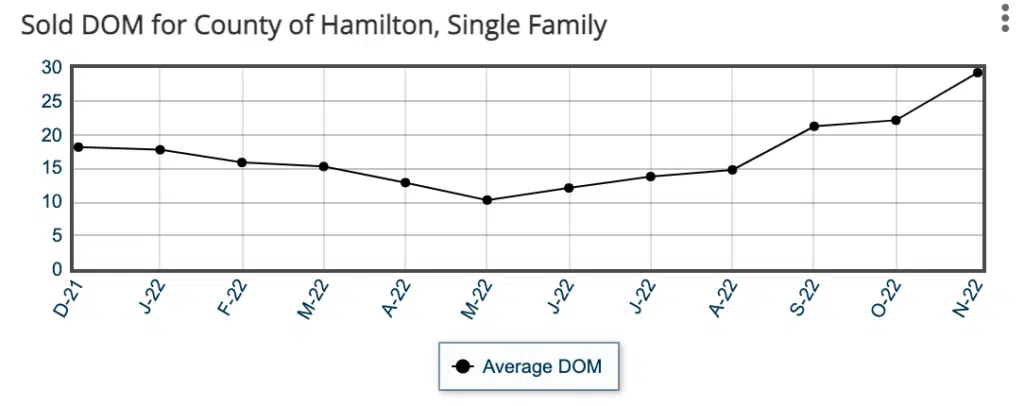

30: Number of days a typical home was on the market before selling in June, up from 13 days a year earlier.

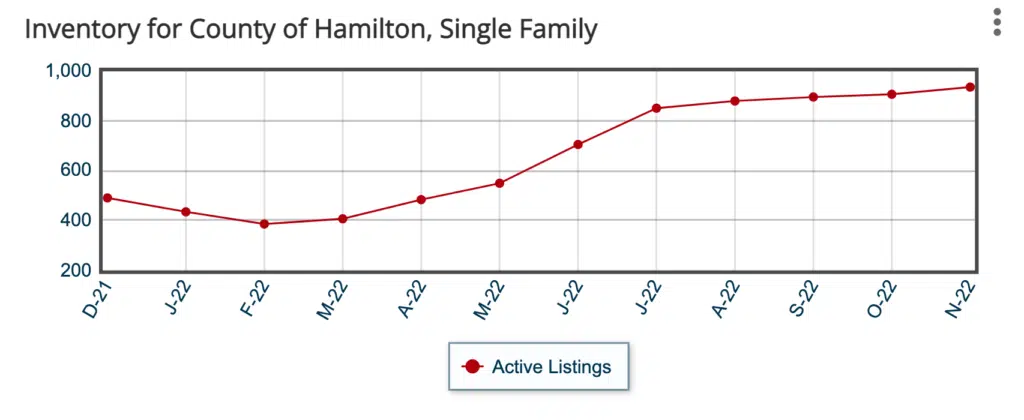

1,778: Number of homes listed in the Chattanooga area last month, up from 1,638 a year earlier.

6.67%: Average rate for 30-year mortgages in June, down from the 7.08% peak in October and

double the 3.22% rate in early 2022.

Source: Greater Chattanooga Realtors, Forbes magazine, U.S. Census Bureau

Chattanooga remains an attractive market for many relocating homebuyers, especially those from high-priced housing states like California, “where a basic starter home there is a $600,000 property,” Sharpe said in a telephone interview Wednesday.

The influx of homebuyers from other cities is keeping Chattanooga as a sellers’ market even with the doubling of mortgage rates and higher home prices, said Todd Henon, another local real estate broker who has sold homes and farms in the Chattanooga area for more than two decades.

“I suspect that well over half of our buyers’ pool is coming from out of the area,” Henon said in a phone interview Wednesday.

The U.S. Bureau of Census estimates that between 2020 and 2022, Hamilton County’s population grew by more than 1.5%, adding 7,440 residents, or nearly 10.2 new residents every day. Statewide, the growth pace was even faster, with Tennessee’s population growing 1.8% in the past two years to add nearly 83,000 more residents from 2020 to 2022, or nearly 114 new residents every day.

The median price of homes sold in the Chattanooga area last month was more than 2 1/2 times the median price of homes sold a decade ago.

2013: $134,900

2014: $141,950

2015: $151,950

2016: $161,000

2017: $175,000

2018: $187,000

2019: $203,000

2020: $230,000

2021: $265,000

2022: $305,000

June 2023: $339,950

Source: Greater Chattanooga Realtors

“We just do not have enough homes for our area,” Henon said, noting that single-family houses continue to sell at more than 96% of their asking price in Chattanooga. “We’re still seeing attractively priced homes get multiple offers, and that pushes prices higher. If a property doesn’t sell right now, it is probably overpriced because there are so many eyes on our market.”

The inventory of homes on the market has grown in the past year and, with the drop in sales, the average time that a Chattanooga house was on the market before selling last month was 30 days, up from the record low of 13 days a year earlier.

Mark Hite, a top-selling real estate agent who heads his own team for Real Estate Partners in Chattanooga, said a healthy market for homebuyers needs more inventory of homes.

“It’s a matter of supply and demand, and we still don’t have a sufficient number of homes being sold on the market to keep up with the demand, even with some slowdown due to higher interest rates,” Hite said in a phone interview Wednesday. “There remains a very strong demand for affordably priced homes in this market.”

Contact Dave Flessner at dflessner@timesfreepress.com or 423-757-6340.

We’re not “tax people”––we’re real estate professionals. But as tax day quickly approaches, we want to share possible tax-saving strategies pertaining to real estate.

Whether reminders or new thinking for your portfolio, we encourage you to consider these tax strategies and, of course, speak with your tax professional.

Our full-service Team is honored to be your real estate resource for Buying, Selling, and Investing. Need a trusted local CPA, tax strategist, attorney, or estate planner? We’re here to put our 30-year network to work for you.

It would be our privilege to sit down soon to discuss your goals.

Our Team of Experts

Rhey Houston, Brittany Fulmer Ennen, Melanie Siler, Sabie Crowder Hennen, Angela Volner, Jim Woodard, Liv Clary, Savannah Ward, Koty Pearse, Beth Bragg Henon, and Todd Henon.

Original Broadcast 9/2023

Realtors Todd Henon and Brittany Fulmer Ennen of Todd Henon Properties join “Let’s Talk Money,” hosted by Jim Place and Jayme O’Donnell of Evergreen Advisors on current local real estate trends. After three decades in the real estate industry, what do these two experts have to say about the recently unusual Chattanooga housing market?

“There’s no question about it, we do not have enough inventory to go around. That has not changed, regardless of the noise inside of the industry.”

– Todd Henon, Broker-Realtor TN, GA, AL

30+ Years in Real Estate Industry

The perfect storm: Low inventory and high demand all leading to a competitive atmosphere, shorter time for houses to be on the market, and the highest recorded average home prices.

“The current average days on market is setting the expectation, specifically for sellers, that it’s okay if your house doesn’t go in 24 hours, it’s also okay, if it does go in 30 days.”

– Brittany Fulmer Ennen, Licensed Realtor TN + GA

Listen to the full episode here:

To learn about 2022’s interest rates, pricing, average days on the market, and more, listen to Let’s Talk Money with Todd Henon and Brittany Fulmer Ennen.

Let’s Talk Money is sponsored by Evergreen Advisors and airs on weekdays at 12pm on WGOW. For the latest Current Market Data, click here.

The value of finding a trusted advocate to walk you through this ever-changing market and the nuanced process cannot be overstated. We would be honored to be of service to you. Contact us to have a conversation about your real estate goals.

Featured: Classic Southern Estate

Record Breaker

Looking Ahead…

Fastest in History

Supporting Data via Greater Chattanooga Multiple Listing Service

If your 2023 goals include real estate–home, investment, recreation, relocation or commercial—we would be honored to sit down and have a conversation. Call us at 423.413.4507.

Sources: GCAR MLS, fred.stlouisfed.org

The driving force in today’s premium-priced Real Estate market is the basic law of supply & demand. Economists predict demand will likely exceed supply nationwide for the next 4-10 years keeping prices and values at a premium.

We’ll explore that next time…

Todd Henon Properties 423.413.4507 direct Info@ToddHenon.com Keller Williams Realty Greater Downtown Realty 1830 Washington Street Chattanooga, TN 37408 423.664.1900

GREATER CHATTANOOGA

SERVING TN, GA & AL

LICENSED TN GENERAL CONTRACTOR

GREATER CHATTANOOGA

INVESTMENT, RECREATIONAL,

DEVELOPMENT, CONSERVATION,

AGRICULTURE

FOR UNIVERSITY OF TN CHATT, ERLANGER HOSPITAL

AGENTS OF CHOICE

AWARD-WINNING MARKETING

SPECIALISTS, CONTRACT MANAGERS,

RESEARCH & LOGISTICS EXPERTS

CHATTANOOGAN TODD HENON

KELLER WILLIAMS REALTY

GREATER DOWNTOWN

1830 Washington Street Chattanooga, TN 37408 423.664.1900

© 2023 Todd Henon Properties of Chattanooga | Keller Williams Realty Greater Downtown Chattanooga. All rights reserved.

Each Keller Williams office is independently owned and operated. 423.664.1900

Realtor Showing Center | 888.594.8304

Privacy Policy | Terms of Service | EULA | Disclaimer | Accessibility Policy